VILLAGE PROPERTY TAXES CONTINUE TO SOAR:

It’s Not My Fault Claims Bill Lewis!

I. Background:

In an off-agenda presentation at the October 7, 2025, Village of Climax Council meeting, President Bill Lewis claimed that he’d heard or read that the Village Council had raised property taxes. At that meeting Bill Lewis tried to demonstrate his innocence in these increases and that of the rest of the members of the Council as well.

Bill Lewis didn’t identify the person who was the source of the accusation of property tax increases by the Council. So, for our purposes here, let’s call the unknown person “I. M. Strawman”.

Mr. Strawman has noticed that his Village property tax bill has increased once again and has done so year after year. He and his wife live in the same house they’ve lived in for many years, made no improvements recently, and yet their property taxes continue to rise.

Mr. Strawman never gave much thought to the idea that the Village of Climax has gotten fat off his tax money – money which he and his wife earned and belongs in his bank account rather than that of the Village. He’s become aware of how much money the Village has socked away far in excess of what it needs to operate and for a rainy-day.

The Village holds an average of approximately $1,000,000 of taxpayer money in its grasp. The Village has so much money that the Council stuffed $250,000 into a CD and is drawing interest off the money to increase the Village’s prosperity even more.

Mr. Strawman has thought about these things now! All of us have. And, we are not happy!

II. Bill Lewis’s Defense:

Bill Lewis claims innocence. The Council has not raised taxes he says. He points out that the tax rate has remained the same. The increase in real property taxes in the Village, says Bill Lewis, is the fault of assessments rising and that causes the taxing entities such as the Village to receive more tax revenue each year. He’s saying that there’s nothing the Council could do. The Council will just have to accept more money from the Village taxpayers. Sad!

Come on Bill Lewis!

Bill Lewis set the millage rate. By lowering the millage rate taxes go down when property values increase. Keep the millage rate the same and taxes go up. Simple math! Just lower the millage rate. Bill Lewis certainly knows this.

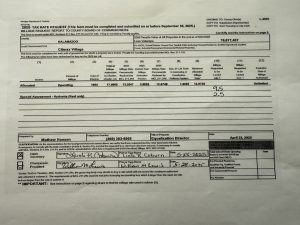

Village officials know what to expect in tax revenue every year. They know the taxable value of real property in the Village and they file state mandated tax levy requests to the county and the township. These tax levy requests, called “Tax Rate Request”, are like placing an order with Amazon, only it is an order for your money via the County. Bill Lewis prepared the latest “Tax Rate Request” a copy of which is below:

One mill (short for millage) is equal to $1 per $1,000 of taxable value. Taxable value is derived from the assessed value by the application of exemptions under the law. The taxable value of real property in the Village has steadily increased over time so that it is predictable that the Village will receive more money if the millage rate remains the same.

He then wrote:

“Figuring out the difference in property tax increases from a local levy and state equalization is possible by understanding how each factor contributes to your taxable value and millage rate. Local governments set the millage rate to be levied, while state equalization adjusts the assessed value, which can affect your taxable value.”

Nothing hard about that. The County does it. The information is available to Bill Lewis. It’s on the form he signed on May 28, 2025. The Kalamazoo County Equalization Department has the information as well. Easy to figure out what the mill levy will produce to know what the Village needs to operate and what rightly should be left in the taxpayers’ pockets.

If the assessed values were going down, Bill Lewis would know that the Village taxable values were going down. He could raise the millage rate to order the amount of money he desired the Village to receive. But, as long as taxpayers are being overcharged to run the Village there’s no need to trouble them with a discussion about the millage rate and their taxes. Mr. Strawman and the rest of us have grown uncomfortable with being left out of the decision-making processes.

With emphasis Bill Lewis then said:

“Your village council only sets the millage rate from the L4029” (The L4029 is the Tax Rate Request Form above.)

Bill Lewis concluded his off-agenda presentation at the Council meeting on October 7, 2025 with this:

“This board (the Village Council) and the previous board have not raised the rate we charge for taxes. The cost increase is out of the Village Of Climax’s boards (sic) control. No matter what is said on public site or in public.”

Really? Out of the Village’s control?! How could you say that?

Bill Lewis is obviously selective about the reality that he accepts. Worse, he is selective about the value of what he tells the Village property owners. As Bill Kortenbach, an author and speaker out of Spokane, Washington said:

“Denial does not solve the problem. Denial does not make the problem go away. Denial does not give us peace of mind, …. . It compounds the problem, because it keeps us from seeing a solution, and taking action to resolve it.

We don’t know whether there were private discussions among some of the Village Trustees about the millage rate or whether it was singularly a Bill Lewis decision out of the public eye. Either way, it would be improper. Bill Lewis attempted to make it look like it was a decision of the whole Council when memory says it was not.

Show us the public record of the Council’s discussion of the millage rate and the amount of taxation to be imposed upon the property owners of the Village! If there is none, this might have been what former President Jim Cummings was talking about when he demanded at the October 7 Council meeting that Bill Lewis:

“End the backroom decision making!”

The Michigan Open Meetings Act requires it.

III. Conclusion:

Village real property taxes are too high. It is an insult to the intelligence of Village real property owners to be told by Bill Lewis that there is nothing that he and the Council can do about it.

This is a matter of public concern for the whole Council. The millage rate is not something for Bill Lewis to decide on his own and out of public view. And not something his denial of responsibility for soaring taxes will solve.

We have the same problem at the Lawrence Memorial District Library where Bill Lewis currently works as the Director. That entity (not a part of the Village) has approximately $250,000, far in excess of what it needs to operate. That millage rate needs to be reduced too.

In the meantime, it is time for rebates to taxpayers.

End